California’s Interior Designers! Sales Tax Secrets with Insights from CDTFA

Are you an interior designer in the Golden State looking to demystify the complexities of sales tax? Well, you’re in for a treat! The California Department of Tax and Fee Administration (CDTFA), the authoritative body responsible for sales tax collection in the state, recently hosted an exclusive webinar tailored specifically for professionals like you.

But here’s the exciting part: our dedicated sales tax expert, Joe, attended this enlightening webinar and meticulously documented every valuable insight just for you. So, grab a seat, and get ready to embark on a journey to unravel the intricate world of California’s sales tax, straight from the source itself!

1) Dive Deeper by Familiarizing Yourself with Tax guide for Interior Designers and Decorators Publication

We get it; as designers, your schedules are jam-packed. So, instead of insisting you absorb every single detail (we know that’s a tall order), here’s a smarter approach: Download, print, and commit the essential sections of this publication to memory.

Don’t worry, we’ve got your back! In this post, we’ll do the heavy lifting and provide you with a concise summary of the crucial insights. You can also read the full CDTFA document for Interior Designers and Decorators here.

2) Confused About Sales Tax Calculations and Have Questions? Our ‘Get It in Writing’ Policy Has You Covered!

If you find yourself still uncertain about how to handle sales tax and have lingering questions, remember our golden rule: ‘Get It in Writing.’

Call the CDTFA, ask to speak to a sales tax expert and follow our steps below to cover yourself:

- Local and district taxes can be complex and difficult to understand. If you have specific questions, we encourage you to put your questions in writing. This will allow the CDTFA to give you the best advice and most thorough response. It may also protect you from owing additional tax, penalties, and interest in case there is incorrect information is provided. It’s always important to have information in writing.

- Requests for written advice can be emailed to CDTFA or mailed directly to the CDTFA office nearest you.

- Responses will be emailed back in 5-7 business days.

3) How do I know if I need a seller’s permit?

- Generally, if you sell any merchandise, including samples or finished drawings, you must obtain a sellers permit from the CDTFA and pay tax on your taxable sales.

- A sellers permit allows you to sell merchandise at wholesale or retail and to issue resale certificates to suppliers.

4) How to Report Tax?

- The total gross sales amount you report must include all your taxable and nontaxable charges for merchandise, labor, professional fees, overhead, delivery and shipping.

- The tax due with each return is based on your total gross sales for the period, plus purchases for your own consumption that are subject to use tax, less any allowable deductions.

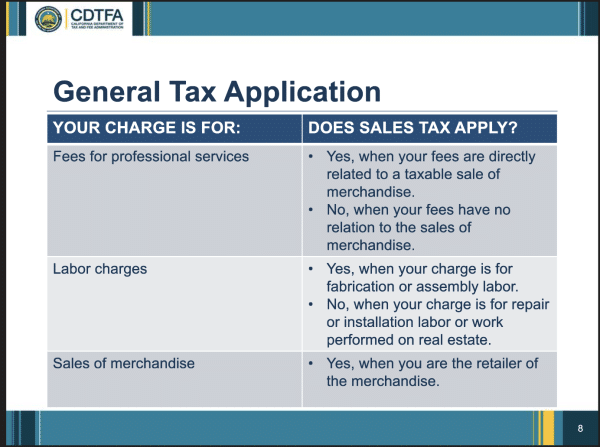

5) Professional Services

- Services may include consulting, design, layout, selection of color schemes, coordinating furniture and fabrics, and supervising installations.

- Tax does not apply to charges for professional services that are not directly related to the sale of merchandise. Be sure to list those charges separately on your invoice.

- However, tax does apply to charges for professional services that are directly related to acquiring and providing furnishings and other merchandise you sell to a client.

- Taxable design time also applies to sourcing and order administration.

6) Labor Charges

- For purposes of calculating sales tax, labor charges are divided into three basic categories: fabrication (includes assembly), repair, and installation.

- In general, tax applies to charges for fabrication labor, but not to charges for labor considered repair or installation. Nontaxable labor charges should be itemized separately on your invoice.

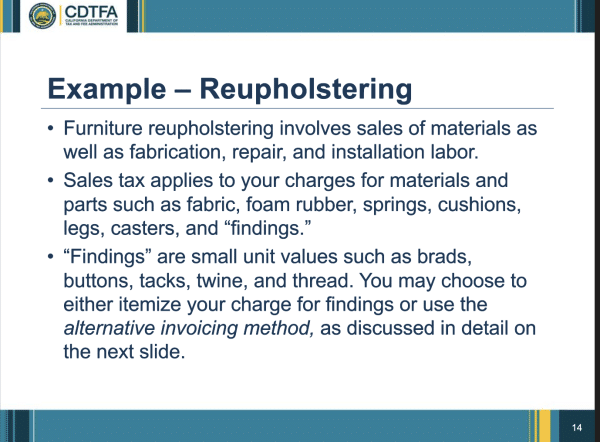

7) Fabrication Labor

- When you make a new item or change the form or function of an existing item and then sell it to your client, the labor is considered fabrication labor.

- Tax applies to your charges for fabrication labor whether you provide the materials or use materials provided by your client.

8) Repair Labor

- Repair labor is repairing, refinishing, or reconditioning and are not subject to tax.

9) Installation Labor

- When you install an item at your clients location you charge for installation labor is non taxable.

- However tax generally applies to the charges for the materials you provide to install an item such as nail, bolts, screws and any other installation hardware.

10) Subcontractor Work

- Your charge to clients for items custom-made by a subcontractor including fabrication labor are subject to tax.

- However if the subcontractor performs repair or installation labor as part of your contract, your charges for that work are not taxable.

- You may find it difficult to properly bill and report taxable and non taxable work because subcontractors may not give a breakdown of materials, repair labor, and installation labor.

- The subcontractors may assume that because their sale to you is for a resale no breakdown is necessary. For your own protection, we urge you to insist on accurate and itemized billings from subcontractors.

11) Sales Delivered Outside of California

- Sales tax generally does not apply to your transaction when you sell a product and ship it directly to the purchaser at an out of state location, for use outside California.

- You must ship the item directly to the out of state destination using your own delivery vehicle, The U.S. mail, common or contract carrier, a customs broker, or a forwarding agent.

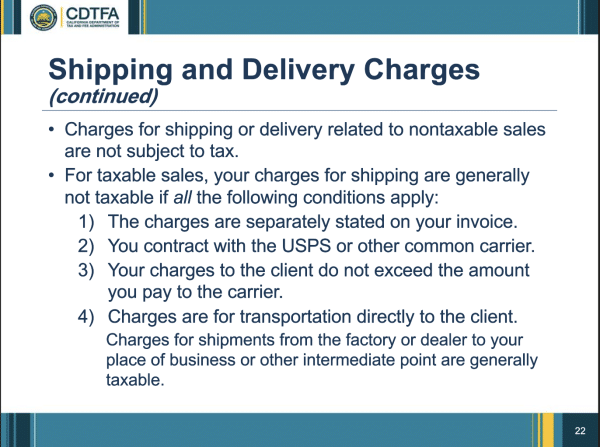

12) Shipping and Delivery Charges

- To represent delivery charges on invoices, you should use terms such as delivery, shipping, freight, or postage.

- If you deliver good using your own vehicle or sell them for a price that includes delivery charges, the delivery charge is usually taxable.

- Other related charges, including handling are generally taxable.

- If you charge an amount that combines postage and a related handling charge, for example shipping and handling, you must apply tax to the handling portion of the charge. The shipping portion is not taxable if it meets all the criteria below:

13) Purchases for resale

- As a retailer, you may issue a resale certificate when purchasing items for resale without paying sales tax to vendor.

- You may also provide a resale certificate to buy materials that will be physically incorporated into items you sell.

- You may not issue a resale certificate when you are buying a product that you will use rather than sell.

14) Items Used for Business Purposes

- Tax generally applies for items your purchase for use in your business and not for resale.

- You should pay sales or use tax at the time of purchase to your suppliers when you buy items not intended for resale.

- If you use an item that you originally purchased for resale without paying tax, use tax will generally apply, and you should report it on your sales and use tax return.

15) Purchases Subject to Use Tax

- If you buy items without paying tax and use the item for a purpose other than resale, you must generally report and pay use tax when you file your sales tax return.

- The use tax rate is the same as the sales tax rate for your location.

- Report of return for the period when it was used.

- The amount of your purchase is reported under “Purchases subject to use tax”.

- If an out of state retailer does not collect tax on your purchase and you use, store, give away, or consume the purchase in this state, you owe use tax and must pay the tax directly to the CDTFA.

- This also applies to an online transaction when you purchase goods online from an out of state retailer and the seller does not collect an amount for California use tax from you and the item was purchased for use in California.

Alright, so there was the lowdown for interior designers in California handling sales tax. We hope Joe’s notes clarified the complexities of sales tax for interior designers in California.

Navigating sales tax for interior designers can feel like a rollercoaster ride, delving into the intricacies of labor charges and what design services are taxable or not. Covering exemptions and purchases without getting tangled in tax rules can add to the challenge. If ever in doubt about charging tax, feel free to ask us. When in that gray area, it’s better to charge sales tax to your client than risk covering the cost through your design business.

With insights from Joe and the support of CDTFA, you’re all set to glide through the sales tax maze as an interior designer in the Golden State. Smooth sailing ahead for compliance and optimizing your finances!

Share On: